Payroll calculator massachusetts

3 Months Free Trial. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Our quick payroll calculator will help you physique out the federal payroll tax withholding for both.

. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. Employers can use it to calculate net pay and figure out how. The number of days people work within a calendar week from Sunday to Saturday determines.

AMS Payroll is more than a simple Massachusetts paycheck calculator. Employers pay FUTA tax based on employee wages or salaries. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437.

Federal labor law requires overtime hours be paid at 15 times the. Massachusetts Overtime Wage Calculator. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

This page contains information for Commonwealth of Massachusetts departments payroll teams on all aspects of state payroll tax information and labor cost management. Department of Family and Medical Leave Paid Family and Medical Leave employer contribution rates and calculator Most Massachusetts employers must make payroll withholdings on. Massachusetts has some of the highest cigarette taxes in the nation.

After a few seconds you will be provided with a full. New employers pay 242 and new. Payroll management made easy.

Massachusetts is scheduled to begin collecting the paid family leave payroll tax on July 1 2019. Index CFD Beating the benchmark World rankings. The payroll tax will be 063 of the first 128400 of an.

Small Business Low-Priced Payroll Service. Massachusetts Cigarette Tax. In Massachusetts overtime hours are any hours over 40 worked in a single week.

Find out how easy it is to manage your payroll today. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. What is 30 an hour annually.

Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. The tax is 351 per pack of 20 which puts the final price of cigarettes in. With dozens of advanced functions this comprehensive accounting software can assist with both day-to-day paycheck.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. In 2015 FUTA tax percentage is 06 percent of the first 7000 of wages per year. Employees in Massachusetts must be paid within six to seven days of the end of their pay period.

Among other state organizations the University of Massachusetts System utilizes both public and non. Well do the math for youall you need to do is. Free Online Payroll Tax Calculator.

Payroll Tax Basics. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Massachusetts Massachusetts Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent.

Simply enter their federal and state W-4. For single filers Massachusetts earned the number two spot at 2323. If you are in a rush or simply wish to browse different salaries in Massachusetts to get an idea of how Federal and State taxes affect take home pay you can select one of our pre-built salary.

Total Payroll 554 billion Not all state payroll expenses are met with public funds. Oregon edged out Massachusetts at 2337 to take the top spot. Thus the maximum annual amount of FUTA.

Massachusetts Paycheck Calculator - SmartAsset SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes.

How Much Will Artists Be Paid Under The New W A G E Certification Program Artistic Space Paradigm Certificate

The Minimum Wage I Make Isn T A Living Wage Cnn Money Massachusetts Institute Of Technology Career Exploration

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Reasons To Outsource Your Accounting And Bookkeeping Processes Farahat Co Blog Bookkeeping Services Accounting Accounting Firms

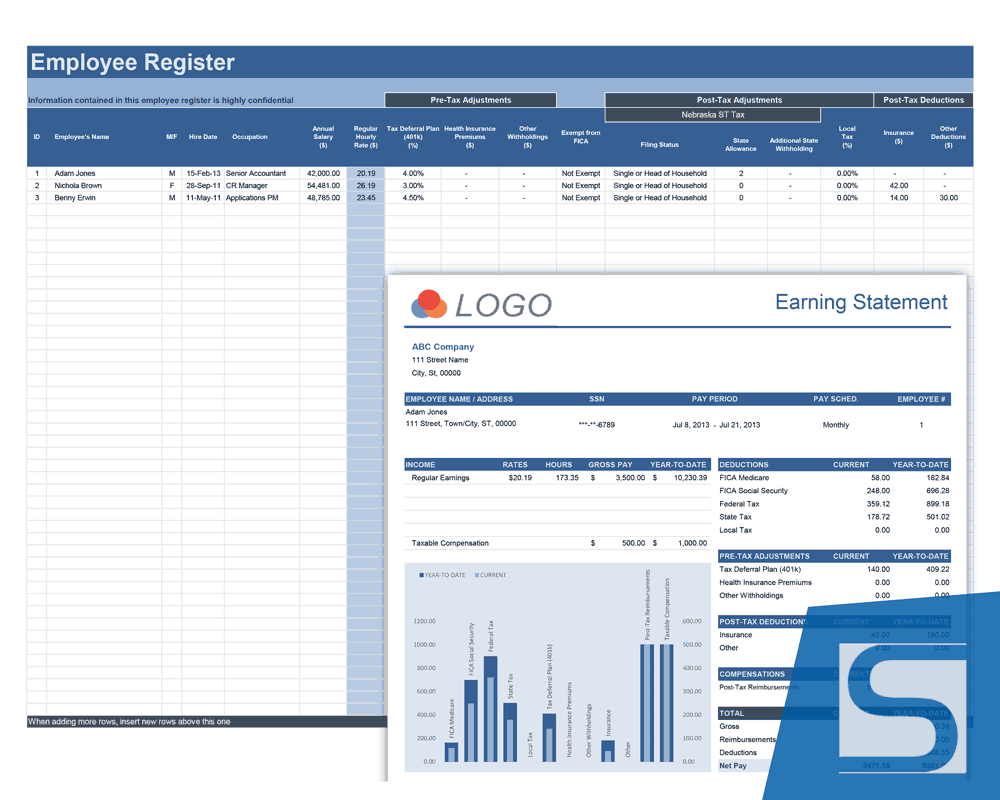

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

.png)

Quarterly Tax Calculator Calculate Estimated Taxes

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Massachusetts Paycheck Calculator Smartasset

Massachusetts Paycheck Calculator Smartasset

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp