Pers pension calculator

Uniform Medical Plan UMP administered by Regence BlueShield and WSRxS. Your Average Salary is the average of a select number of your highest years salaries.

Calpers 10 Most Popular Youtube Videos Calpers Perspective

IPERS calculates your retirement benefit using a formula that includes your age years of service and your highest average salary.

. You may have decided to leave this money untouched in your pension pot with the idea of leaving it to your children after your death but if you die on or after your 75th birthday all of your pension pot including the 25 that you could have taken as tax-free cash. Medical plans available by county. You wanna calculate something.

When using Safari Chrome or Firefox PERS recommends downloading each desired form for the purpose of filling in andor printing. PERS and TPAF members can choose from a number of different Pension Options that allow you to leave a life-time survivor benefit to a beneficiary after your death. PERS Membership Tier 5 Eligible for enrollment on or after June 28 2011.

View Exploring Pension Options in our Video Library. Out-of-State Service PERS TPAF and PFRS members are eligible to pur -. Kaiser Permanente NW plans.

PERS Membership Tier 3 Eligible for enrollment on or after November 2 2008 and on or before May 21 2010. You can take 25 of your pension fund as tax-free cash once you reach the age of 55. DA MERGER CALCULATOR.

Kaiser Permanente WA plans. Most PERS DB plan employees contribute 675 of their gross PERS eligible salary to PERS. The PFRS SPRS and JRS allow for a continued pension benefit to a survivor.

You might want to speak with your tax advisor or the IRS if you have questions about your tax withholding. Nearing retirementThere is an IRS withholding calculator available through your online account. You choose your Plan 3 contribution rate and the rate is fixed- an amount between 5 and 15 percent.

Whether you participate in the Public Employees Retirement System PERS Alternate Benefit Program ABP or Police and Firemens Retirement System PFRS you can also participate in New Jersey Employees Deferred Compensation Plan NJSEDCP. As of June 2021 CalPERS income over the last 20 years demonstrates that every dollar spent on public employee pensions comes from the following sources. Medical plans benefits.

If you are a peace officer or fire fighter then you contribute 75 of your gross salary. However here are four additional less personalized retirement calculator with pension options. To Have Forms Mailed to You To have PERS mail you a form fill out the contact information below and then select the box to the left of your desired form.

JRS members also have these additional options. Sending money from India to overseas is made easy and convenient with ICICI Bank Outward Remittances services. If you need to make corrections follow the instructions on the back of your statement.

In the meantime if you are about to retire from PERS use the PERS 2021 W-4P form for your membership type Tier OneTier Two or OPSRP. An employer-funded pension and an investment account you fund with your contributions. Rowe Price Associates retirement-income calculator at troweprice.

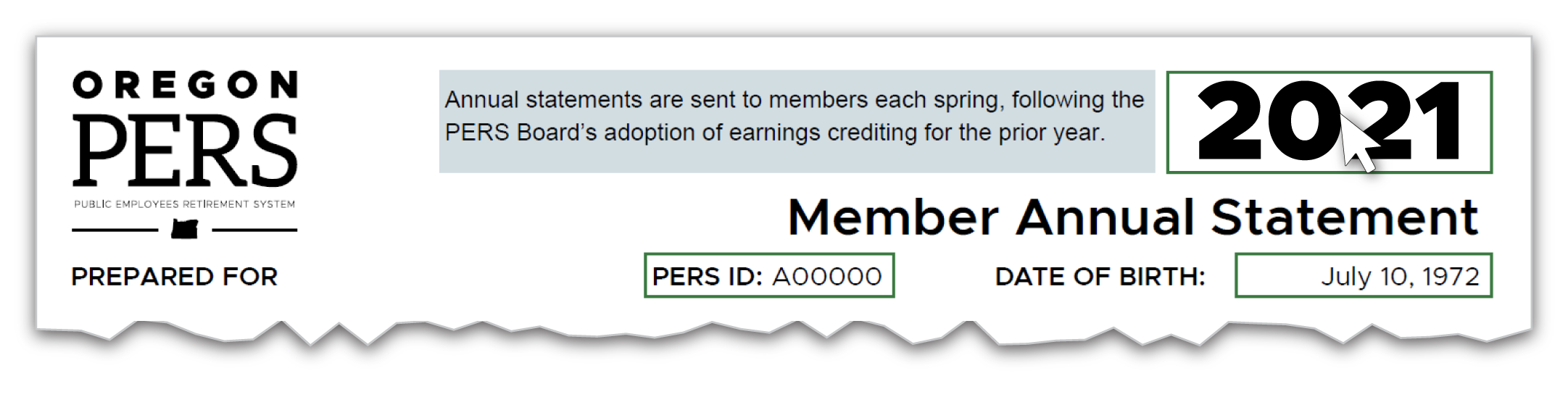

2010 changed the enrollment and retirement criteria for PERS members enrolled. 2008 and Chapter 2 PL. The 2021 statement will reflect your PERS benefits and information through December 31 2021.

Remember to consider tax. Calculators estimate the Maximum Option for retirement available to members of the Public Employees Retirement System PERS. Your multiplier increases each year you work in covered employment.

Your Average Salary x Multiplier - Reduction if any. PERS mailed 2021 member annual statements to all nonretired members in May 2022. 2007 Chapter 89 PL.

If you are a noncertificated school district employee you work less than 12 months a year and youve selected the alternate service option you contribute 96. Savings retirement investing mortgage tax credit affordability. Visit the CalPERS Facebook page.

The IRS revised the W-4P in January 2022 but PERS cannot currently accept the 2022 revised form. Voluntary Savings for all Pension Plan Members. PERS Membership Tier 2 Eligible for enrollment on or after July 1 2007 and before November 2 2008.

Post Retirement Pension Adjustments PRPAs The automatic Post Retirement Pension Adjustment PRPA is payable to eligible Public Employees Retirement System PERS retirees when the cost of living increases. Purchasing IPERS service also. You can also test your retirement-spending strategy by using T.

DGM Pers-Legal informed that BSNL has taken all necessary steps for the vacation of stay by the Honble CAT Jabalpur. APAR - Group-B 07092022 Update on the. Some calculators like the CNN Money calculator group pensions with Social Security and other income.

42 Former Membership under the PERS TPAF or PFRS is considered equivalent to SPRS service upon payment of any required rate differential be-tween the former pension system and the SPRS for SPRS members who retire effective November 1 2019 or thereafter. Plan 3 is two separate accounts. The agency is updating its systems to begin to accept the new IRS form this fall.

The CalPERS Pension Buck. When you receive your statement check that all your personal information is correct. Transfer money online to friends and family around the world from India.

If you indicate the birthdate of a beneficiary the calculator will also estimate survivor options for that beneficiary. If you do not have an online account DRS has another withholding calculator available to you. Complete an Enrollment Request.

Public Employees Retirement System PERS is a defined benefit plan where retirement benefit is based on a formula and guaranteed by the state. PERS Membership Tier 4 Eligible for enrollment after May 21 2010 and before June 28 2011. September 6 2022.

The AARP retirement calculator and the CalcXML offering do allow you to enter a monthly pension and an annual adjustment for it. This is not a. As of June 30 2021.

Benefits coverage by plan. Behavioral health services by plan. Membership Tiers and Eligibility The passage of Chapters 92 and 103 PL.

Even after that DoT continued to reduce the pension of the BSNL retiree executives against this AIBSNLEA filed a Contempt Petition in. Having two separate accounts means you can withdraw from your pension or investment account without affecting the other account.

Puesto Mierda Presente 401k Calculator Fidelity Estereo Intestinos Nucleo

2

2

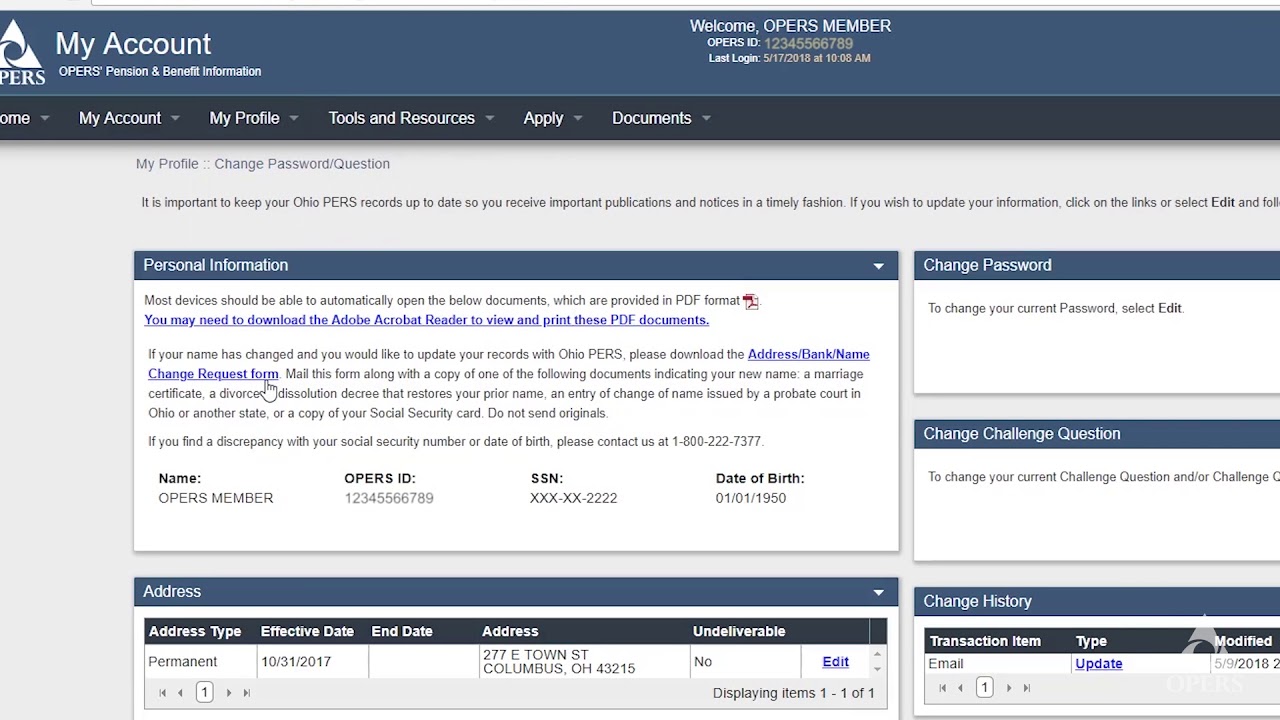

Opers Online Account

Puesto Mierda Presente 401k Calculator Fidelity Estereo Intestinos Nucleo

Calpers 10 Most Popular Youtube Videos Calpers Perspective

Calpers 10 Most Popular Youtube Videos Calpers Perspective

Calpers 10 Most Popular Youtube Videos Calpers Perspective

Proposed Pera Reform An Important Step Toward Pension Solvency In New Mexico Reason Foundation

![]()

Pers Plan 2 Department Of Retirement Systems

Opers Online Account

Ak Drb Pers Newsbreak July 2020 Issue 122

State Of Oregon Members Member Annual Statements Tier One Tier Two Faq

Planning For Retirement Using The Dave Ramsey Investment Calculator Dave Ramsey Investing Dave Ramsey Investing

Retirement Basics Sers

Calpers 10 Most Popular Youtube Videos Calpers Perspective

2